Multiple Offers Still Alive and Well in Toronto

3 BEST OPTIONS

This past week, one of my young investors made an offer on a unit at Fly condos, located at 352 Front street west. We submitted our offer with this condo being on the market for 5 hours, with only virtual showings. Long behold, within an hour of our offer being received, we were in competition. Ultimately we lost in the multiple offer bid, as the other offer was stronger than ours. I have been an advocate for this building, as an excellent investment since 2014. Over the years, I have sold about 25 units in this building. There is a notion out there, that the Toronto condo market will have a depression in prices due to Covid-19. I strongly disagree with this notion, for one simple reason. Any investor, purchaser or real estate enthusiast who has been following the real estate market for the past 10 years should have learnt one simple rule about the Toronto condo market. It’s a special market! Real estate is all about micro-markets and no market in Ontario is like the Toronto condo market. Within this market, there are many sub-markets and the core is where the true investors belong.

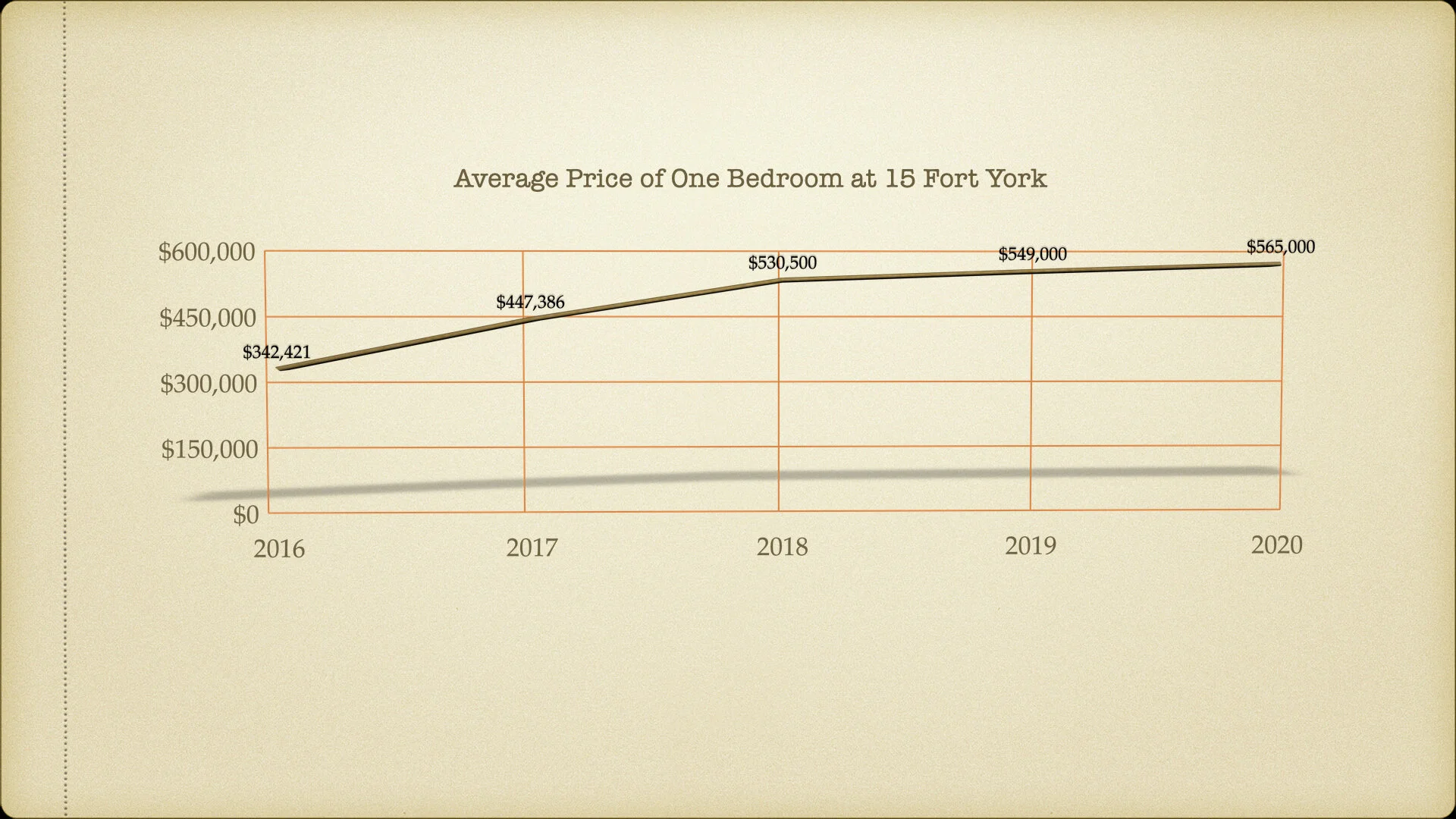

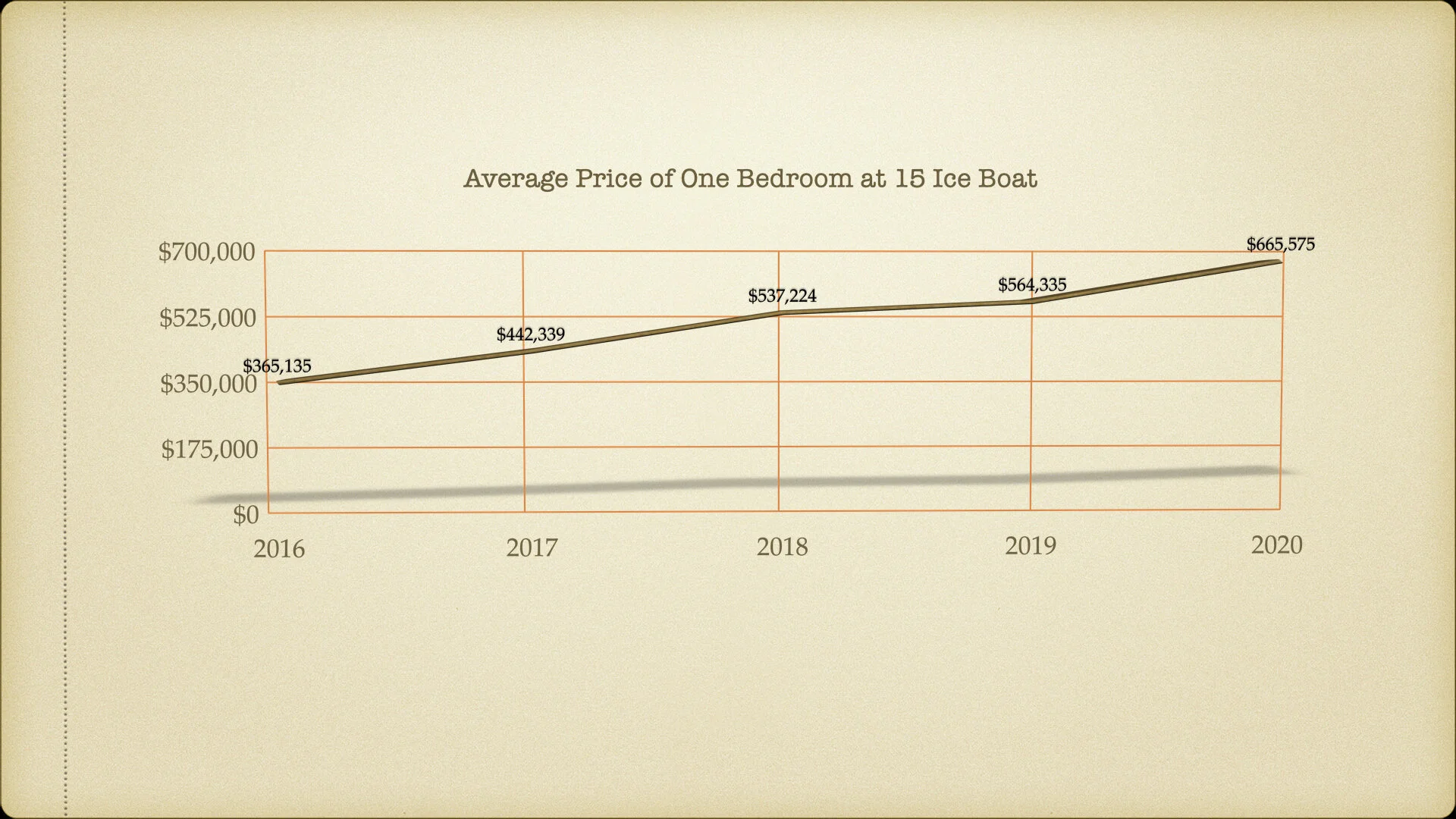

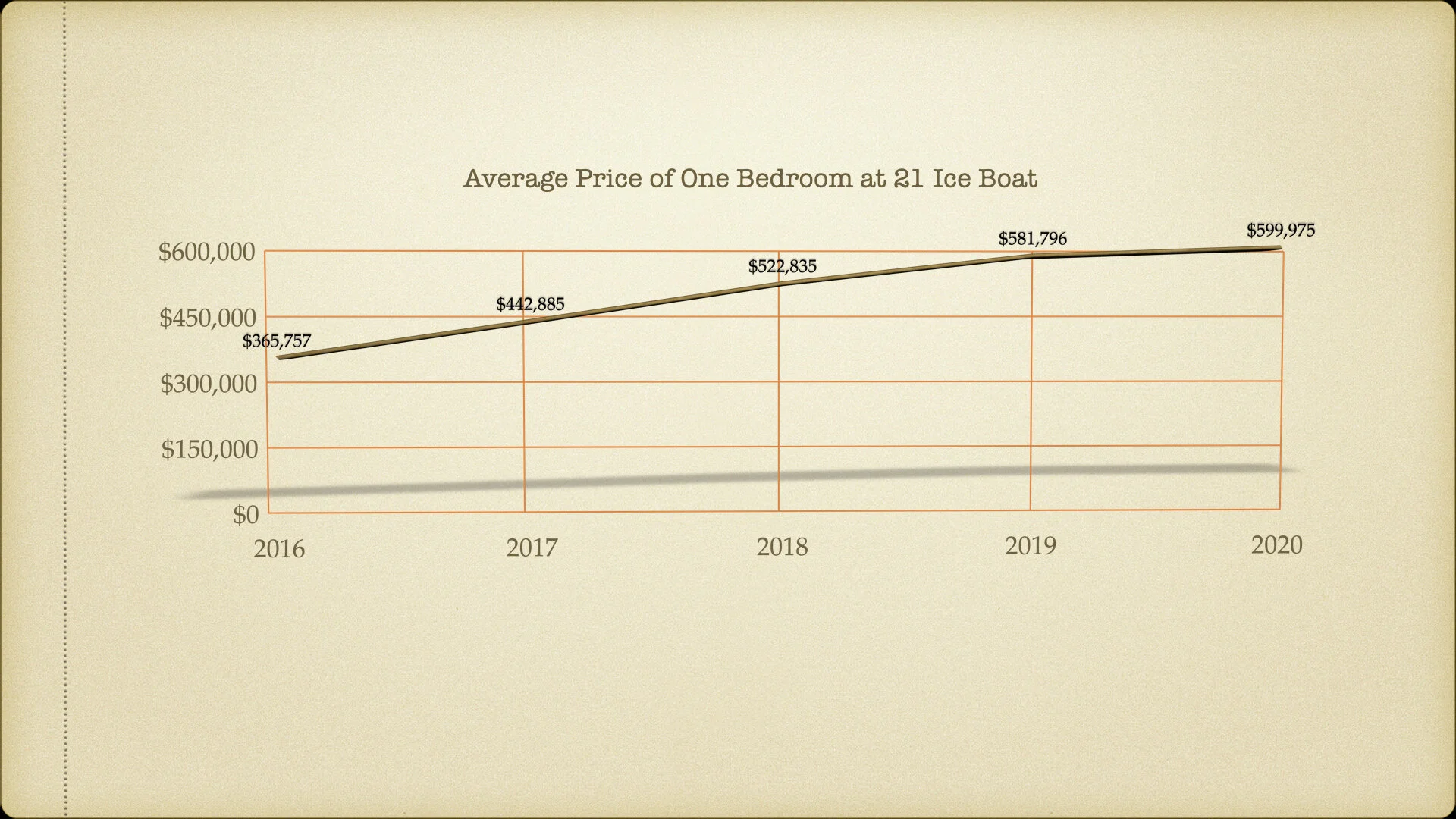

Looking at the average sales prices for one bedroom condos in these three buildings over the past 5 years. There has been a regular upswing in prices. With construction at The Well on course, these three buildings will see a spike in prices as a result of the Law of Progression in real estate. The occupants of these buildings will also enjoy the food and restaurant markets of The Well. However, the purchasers of these buildings will pay $300-$400 less per square foot at these buildings.

Obviously there is no comparison in quality of these three buildings compared to The Well project. However, for investors, the return on investment is based on capital appreciation on their initial investment.

The WELL by Tridel is the main reason, why all buildings in Cityplace will increase in value. As the core reaches norms of $1150/square foot for resale and as high as $1550/square foot in pre-construction, these buildings are bound of sound capital appreciation.

The current market has an opportunity for investors, for the next 1-2 months. Once the city’s phased plan reaches the 3rd phase, there is surely going to be a surge in the market. Also, the rental market in Toronto alway peaks around July end to mid August. This is due to the influx to new residents in Toronto, who move for education, new jobs and immigration. Therefore, if you are considering to make an investment in the Toronto condo market, the next few weeks are crucial. The Toronto condo market has proven its resilience since 1996 and more recently during 2017, when most markets in the GTA took a price plunge. So, don’t try to time the market yet again! Let’s schedule a call to discuss your next Toronto condo investment.

Call Samir