Navigating through Covid-19's effects on the Toronto condo market

March 25th to April 29th - 2019 vs 2020

As we enter the 5th week of this Covid-19 pandemic, I have been keeping a close eye on the activity of the Toronto condo market. During this pandemic, I am comparing 2 week periods from 2020 to the numbers from 2019. Seems like everyday, I speak to a client of mine who has a doom and gloom outlook at the market. I have always backed my commentary on the market, with actual numbers.

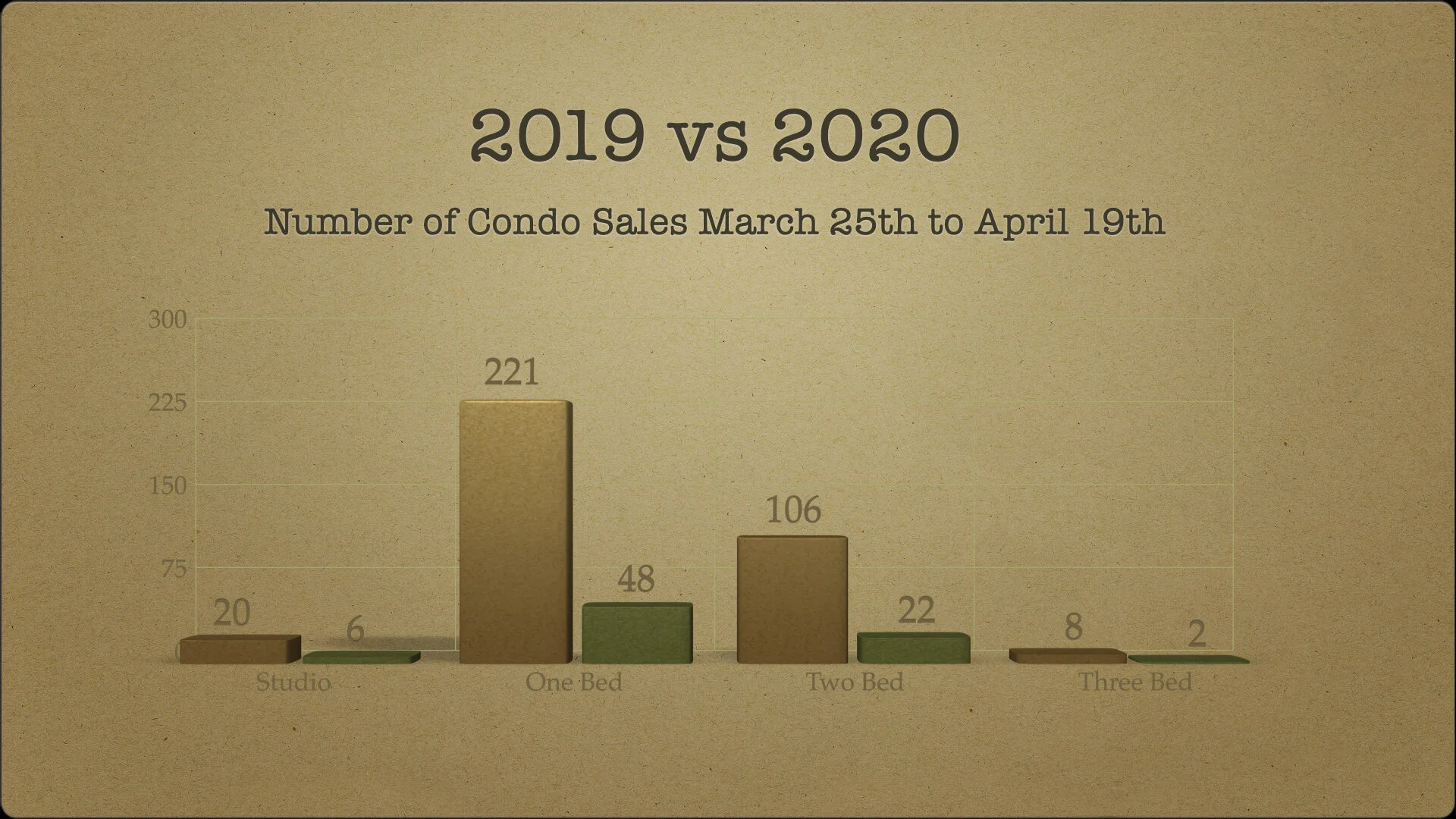

Condo Sales Numbers

There were a total of 355 sales in 2019 compared to only 78 in 2020. That is a 78% drop in activity during this period. Covid-19 has certainly created an engagement problem in the market, as the numbers prove it.

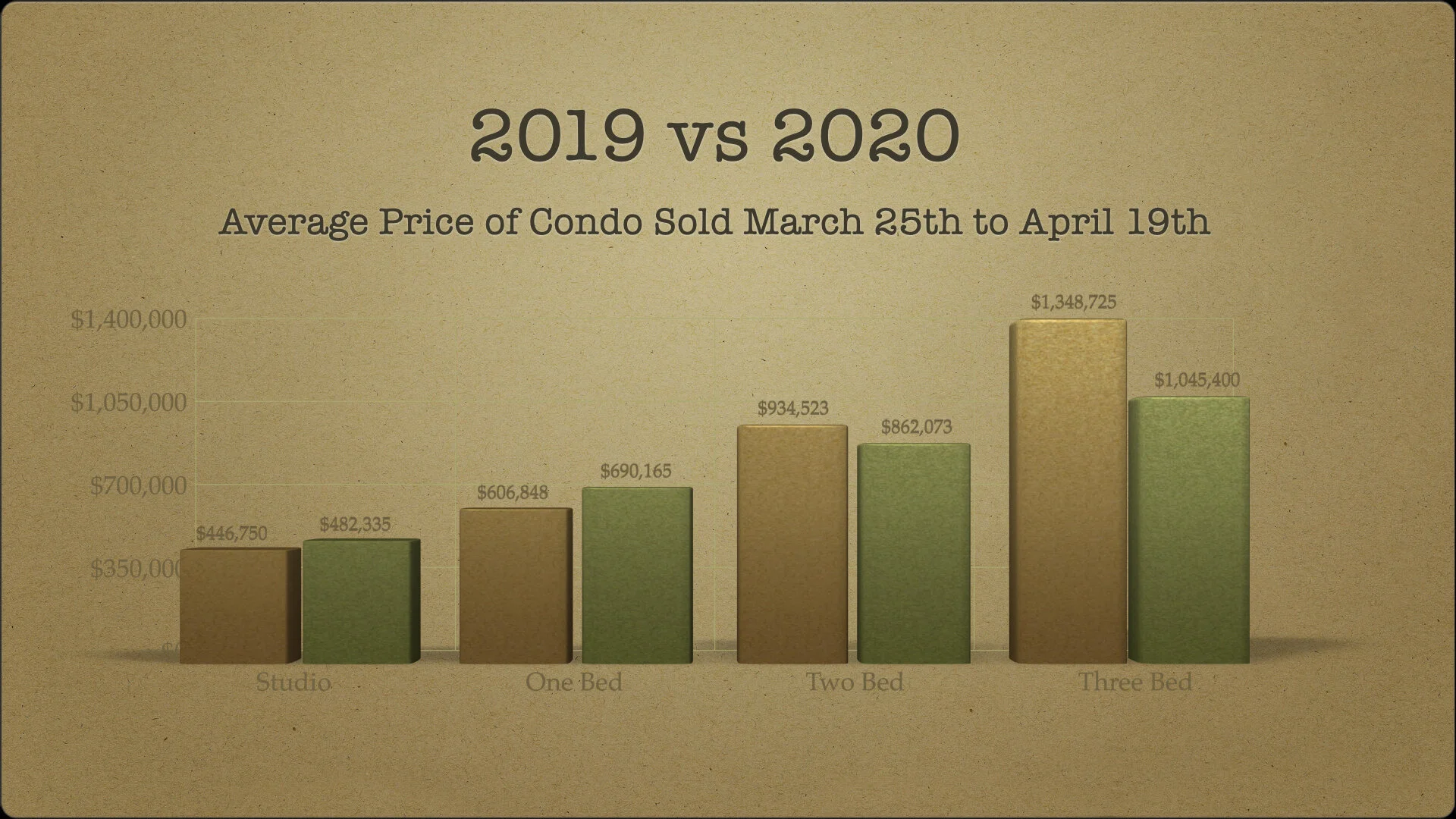

However, the average price of a condo sold during this period has risen by 7%, year to year. Therefore, even though the activity is down by 78%, that has not had a affect on the average price of condos in Toronto.

The bulk of activity has been for a one bedroom condos during this time, constituting for 78% of all sales in 2020. The other number always to pay attention to is days on the market. And surprisingly, the days on market has decreased from 16 days in 2019, to 12 days in 2020. However, the lack of multiple offers plays an integral part in this adjustment in activity.

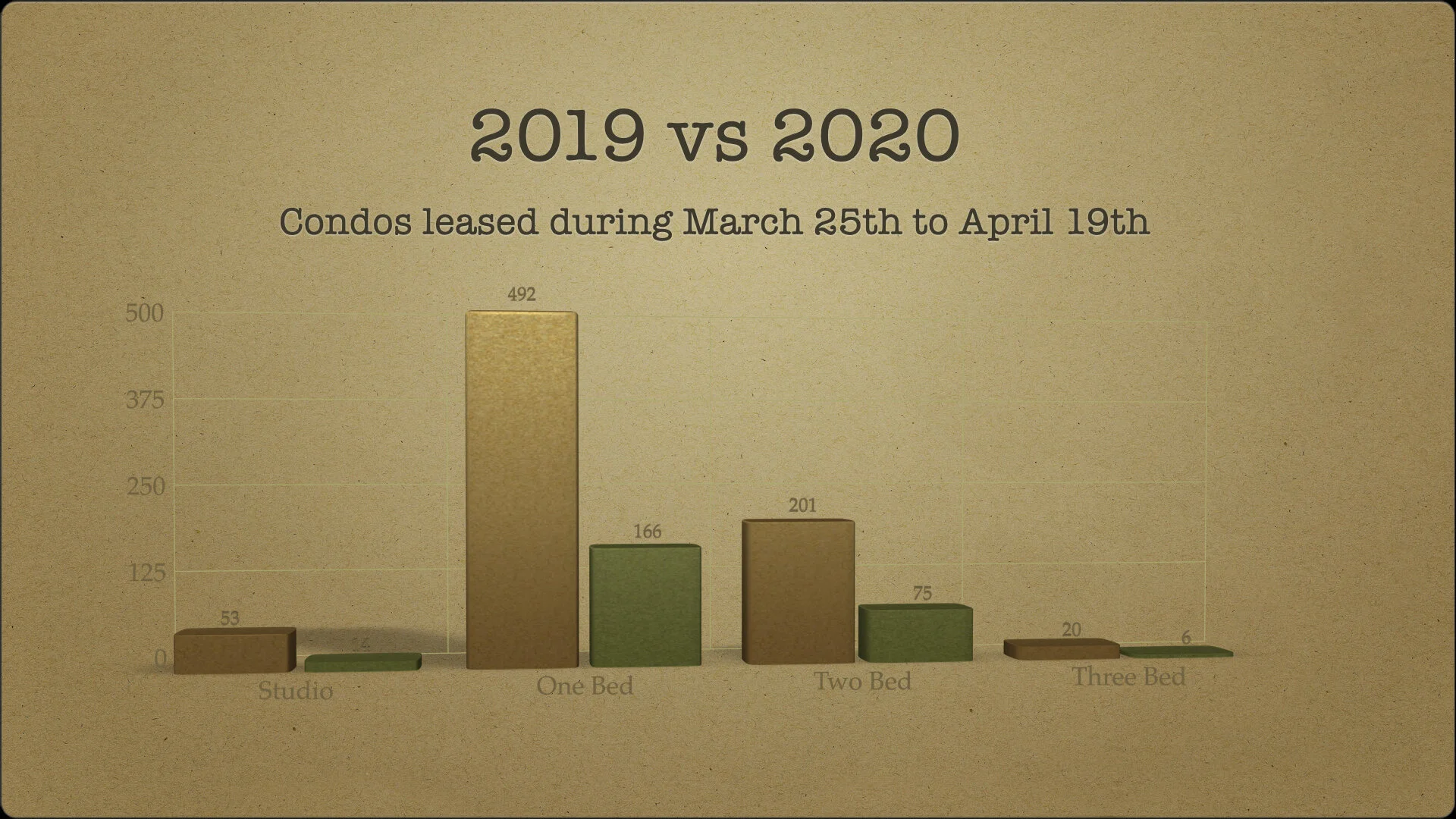

LEASING

Leasing has always been an important facet of investing in Toronto. For the past 9-10 years, Toronto has had vacancy rates for less than 2-3%. Covid-19’s biggest impact has been on the leasing activity. There were 766 units that leased during this time in 2019. That number has decreased to only 261 in 2020. That’s 505 less condos, leased during this period.

Looking at average lease prices, overall, there hasn’t been much difference yet. However, as this high inventory of available condos gets absorbed, its safe to assume that average rents will decline for the short term.

In summary we have to wait for the city to open in stages. One constant that will not change is the number of new admissions in Med school, Dentistry and Law school. The new hires coming into the city in the summer. I believe the rental market will heat up around end of July, and we will see stabilization in rental rates and vacancy. This is an excellent time for an investor to jump into the market, and negotiate a long closing. There will always be sellers, who will panic and might sell for less than the market value. If you are interested in looking at some of these opportunities, please get in touch with me. I am still showing properties to investors and I can also present properties virtually.

Looking to Invest

Let’s meet online!